Market Cartography,

free sorting, clustering techniques

Brands need a better understanding of their competition, their category and themselves

Today's shoppers are confronted with an ever-increasing number of products on the shelves. As a result, consumers can quickly become confused and overwhelmed, especially if the order on the shelf does not match how they structure the offer.

For our clients, this means a growing need for contextualisation and a broader understanding of the market to understand the positioning of their products within the competitive market and the codes and trends of the category.

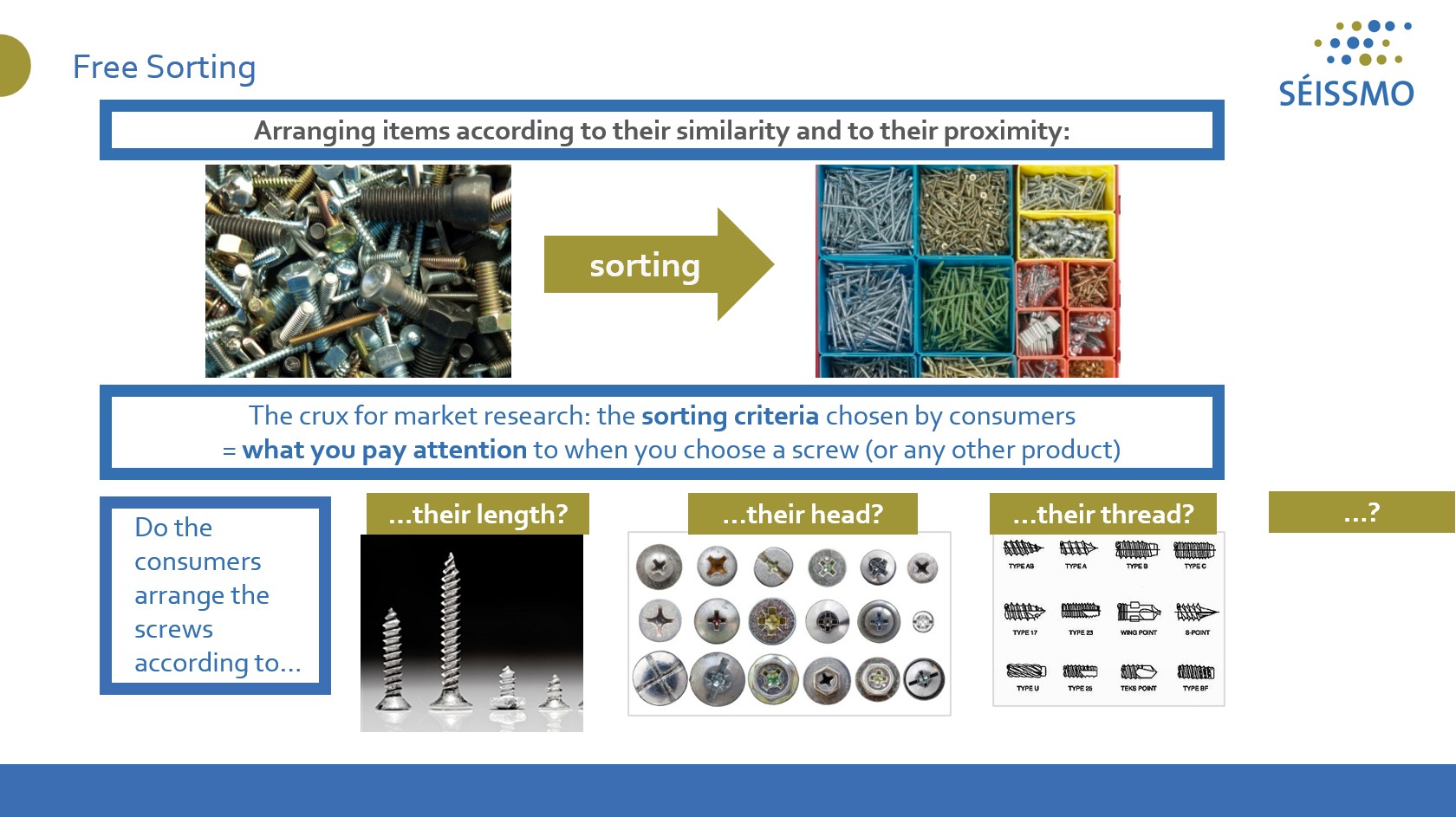

Consumers have their own categorisation of products, which can be very different from the shelf structure

By taking the products off the shelf and allowing the consumer to organise them according to different criteria, we find out which criteria are important to the shopper and why. From this we derive the intuitive shelf structure.

At Séissmo, we have been constantly refining this method. We have applied free sorting/clustering to over 100 research questions across various FMCG categories and developed our own free sort techniques into a comprehensive tool we call Market Cartography.

What makes our way of clustering special?

- The items are sorted multidimensionally, not only unidimensionally.

- Consumers always sort products according to their own criteria.

- We usually do several rounds of free sorting to reveal the deeper hidden or slowly emerging (trend) variables, as the criteria are not immediately obvious.

- After sorting, a projective discussion of the territories is essential to understand the dynamics within and between the clusters.

- Each research question requires the use of appropriate methods and techniques. Hence, we use different types of market cartography to understand who your competitors are, what the rules of your category are and how consumers approach your products.

- We are also adapting our approach to the needs of each market: in China we will use different techniques than in Germany or the US. For example, in China it is not possible to cluster families because they are too small, nor is it possible to cluster political regimes.

The method is also ideal for testing new products and finding out how your innovations are perceived. They are simply foisted on consumers as "Easter eggs" among the products to be sorted.

Read more on Shopper research

Visual translation, live sketch artist to develop shop concepts

“Do-it-your-shelf” (ideal shelf set-up)

“Do-it-your-shelf” (ideal shelf set-up)

Related articles

The other 3 pillars of our research expertise

Exploratory Research

WE DIG TO THE BOTTOM of consumers' minds

- Consumer attitudes, behaviour, drivers and barriers

- Usage patterns and habits, customer journeys

- Lifestyle research

- Market landscape, mental maps

- Latent needs, new territories

- Consumer segmentation, typology, persona

Brand & Strategy Research

- Advertising impact

- Product re-launches (360° marketing checks)

- Packaging

- Prices & promotion

- Marketing mix coherence, portfolio

alignment

Product & Packaging Test

- Opportunities for adopting new concepts and ideas (both products and services); addiction factor

- New formulas, flavours, fragrances, textures, colours, shapes, dosage forms, handling, devices, packaging materials, service components, names, claims, etc.

- Customer & user experience